It should come as no surprise that payroll is a critical function in any modern-day business. If employees can't pay their employees on time and accurately, employees may question the company's financial stability. Additionally, conflicts around paychecks can dramatically lower staff morale and potentially lead to a high employee churn rate. The result? The company gets a bad reputation for being a disorganized or negligent employer, and attracting top talent in the future becomes challenging. Lastly, many countries have strict regulations around how companies pay employees, what data they need to record, and for how long.

Payroll systems help overcome these challenges by enabling companies better visibility and control over their payroll data and activities.

Payroll Management Explained

Regardless of the number of workers, all employers must keep payroll records. The exact records vary from country to country, but typically, companies need to collect and maintain information like:

- Name, address, and Social Security number (or equivalent, e.g., National Insurance Number in the UK).

- Amount and date of each payment for work done.

- Amount of tax-deductible and tax code status.

- Documentation relating to an employee's resident status in the country (e.g., citizen/resident/VISA considerations).

- Pensions, benefits, and other payroll deductions.

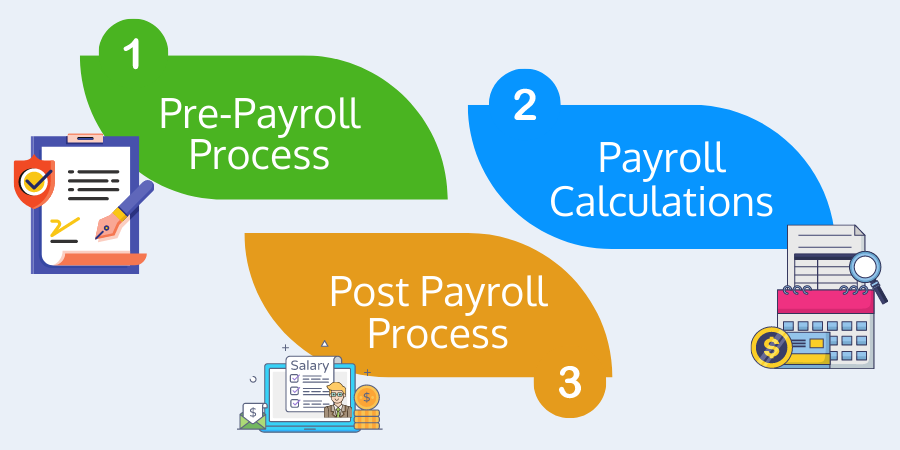

The payroll management process is a repeatable and regulated set of steps that the company performs every month as a part of the payroll cycle. For example, a typical Payroll process might look like this:

Pre-Payroll Process (Step 1)

In this stage, the Payroll team defines time and attendance policies, pay policies, leave and benefit policies, and any reimbursement policies. They also interact with multiple teams to gather payroll data for each pay cycle, for example, whether an employee's salary has been revised, whether there are any authorized or unauthorized absences, and so on. Essentially, any information that could alter typical pay needs to be captured. Lastly, the payroll team must validate this data against the payroll policies.

Payroll Calculations (Step 2)

Once the team has gathered all the necessary payroll information in the weeks up to payday, they then need to perform the payroll calculations. The payslip will contain information about this process, for example, Net Pay, Net Take Home Pay, and any deductions. This step is critical.

Post Payroll Process (Step 3)

This stage involves keeping accurate records of actual monthly payouts to ensure compliance and other critical activities like payroll accounting (keeping a record of all financial transactions). It's also in this stage that employees actually receive their payout, and you can put a smile on their faces!

Why Payroll Management Systems are Invaluable to Businesses

Payroll is too critical of an activity to be left in the hands of error-prone manual processes. Payroll management systems dramatically reduce the risk of costly payroll errors and offer a whole host of additional features that make life easier for HR employees.

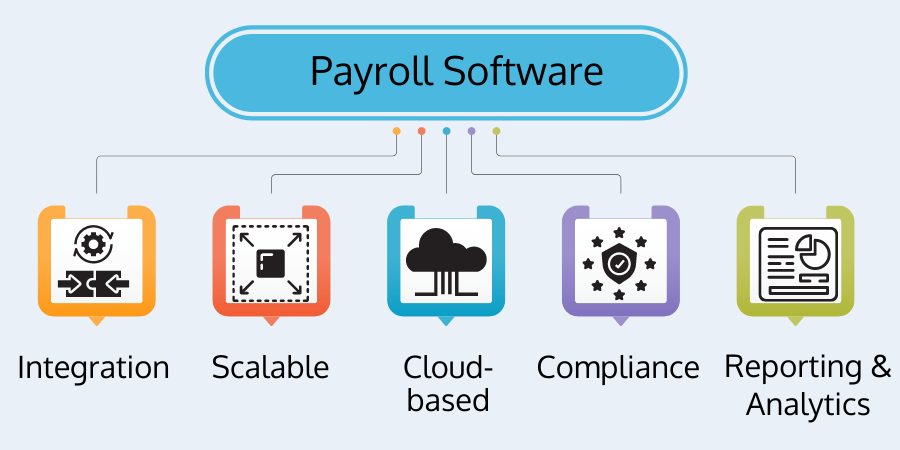

What Should You Look For in Payroll Software?

While features vary between suppliers, here are some of the key features you don't want to miss:

- Integration - The software you pick should integrate with your current systems. For example, you might already have an accounting system or an HR system you want to keep. Newer companies can instead opt for a comprehensive system that does everything.

- Scalable - You want a system that will scale as you scale.

- Cloud-based - The payroll team should be able to access the payroll management system from anywhere and see live information.

- Compliance - The system should be able to meet your regulatory and compliance obligations.

- Reporting and Analytics - Payroll reporting, analytics, and forecasting are essential in the modern business world. It empowers businesses to make better decisions about the company moving forward.

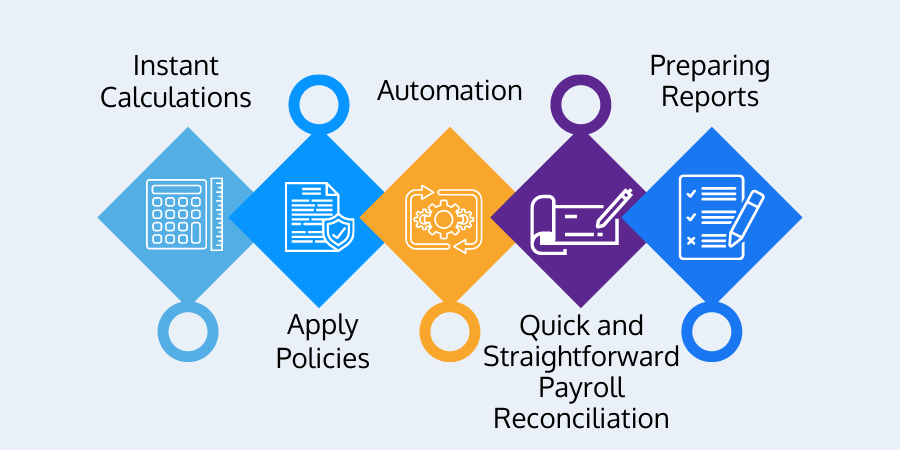

Benefits of Payroll Management Software

- Instant Calculations - Payroll calculations must be accurate, or employees won't be paid the correct amount. Payroll software can accurately work put calculations and deductions very quickly.

- Apply Policies - Calculate bonuses, vacation pay, expenses, and so on with the minimum effort.

- Automation - Payroll software allows you to automate tasks like end-of-year reporting.

- Quick and Straightforward Payroll Reconciliation - Companies need to verify the accuracy of each payroll after each cycle to ensure nothing was missed. Doing this manually is labor-intensive and time-consuming. However, with payroll technology, reconciliation happens automatically in the background with payroll technology and will alert the payroll team of any errors.

- Preparing Reports - Payroll systems make reporting easy work. They typically have customizable templates for generating multiple reports like tax reports, overtime hours, reconciliation reports, absenteeism, total wages paid, and so on.

Batoi Corporate Office

Batoi Corporate Office