If you want to run a successful business, you need to make money. How do you ensure you get that money? It’s through invoicing and billing. Understanding these terms and how they work is essential.

What's the Difference Between an Invoice and a Bill?

The terms' invoice' and 'bill' confuse many people. Invoices and bills often contain similar information and result in the same response (sending payment). However, there are distinct differences between the two. To understand these differences, let's look at the components of both invoices and bills.

What is an Invoice?

An invoice is a commercial document issued by a business to its clients. An invoice typically includes detailed information about the services rendered, the client, and more. Here are the details typically included in an invoice:- A unique invoice number that both companies can use to reference the invoice.

- The name, address, and contact details of the company issuing the invoice.

- The name and contact details of the company receiving the invoice.

- A description of the product or service covered in the invoice.

- The date goods or services were supplied.

- The date the invoice was created.

- The amount of money owed, typically broken down by units, and details of any discounts, VAT, and so on.

- The total amount due.

- The payment deadline.

In simple terms, an invoice is a business' way of requesting payment by a specific deadline. It's also a record of the goods and services a company has sold.

What is a Bill?

A bill is a commercial document that outlines the amount a customer owes for goods or services received and is written as a statement of charges. A bill acts as legal evidence for both parties (the buyer and the seller) that a sales transaction took place. Bills are typically used for one-time, upfront payments. For example, when you go to a restaurant, you receive a bill and not an invoice. Bills are common in places where you're expected to pay straight away, like grocery stores, restaurants, and entertainment venues. However, it's not uncommon for all types of businesses to issue bills.

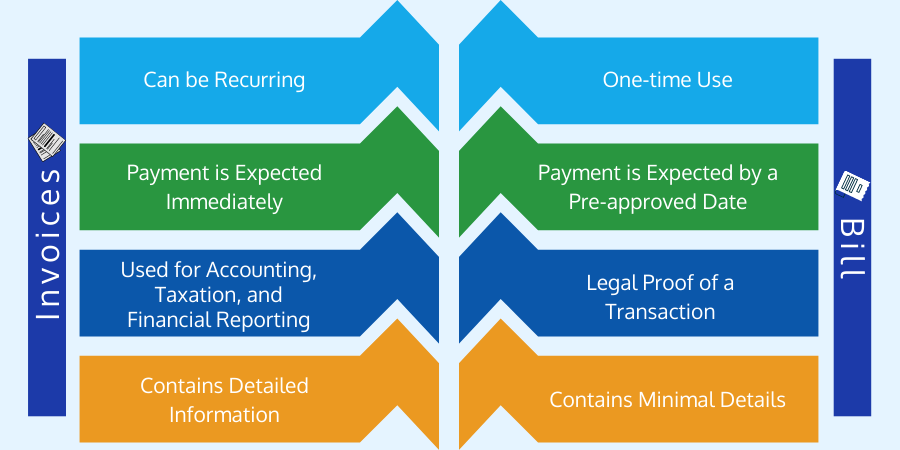

Key Differences between Invoices and Bills

- Invoices can be recurring, whereas bills are for one-time use.

- With a bill, payment is expected immediately, whereas with an invoice, payment is expected by a pre-approved date.

- A bill is legal proof of a transaction, while invoices are used for accounting, taxation, and financial reporting.

- Invoices contain detailed information, while bills often contain minimal details. For example, a bill may only include the price of goods and any taxes.

Here's an example of the different roles of invoices and bills in practice. Sometimes a business will issue multiple invoices as a record of goods/services rendered but will then follow up with a final bill with the total amount due.

Adding to the Confusion

Everything so far sounds straightforward, but we're about to add some confusion into the mix. The way we've described invoicing and billing above is accurate, but you may hear these terms used in different ways. For example, sometimes, the recipient of an invoice will refer to it as a bill. And sometimes, an hourly consultant will "bill a client" or refer to time worked as "billable hours" but issue an invoice.

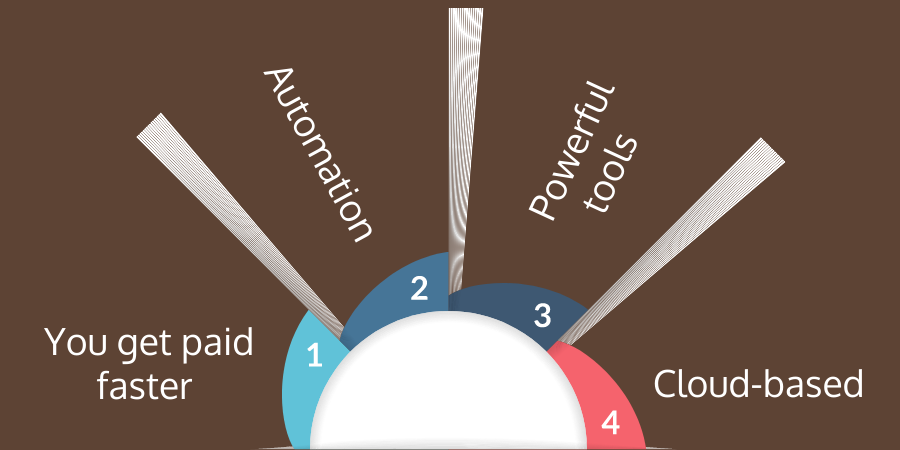

Why You Should Use Invoicing Software over Invoicing Templates

Many word processors like Microsoft Word or Apple's Pages will offer invoicing templates, but these can create as many problems as they solve. Today, invoicing software is the preferred choice for modern companies. Here are some of the reasons your business should use invoicing software over traditional templates:

- You Get Paid Faster: Invoicing software is specifically designed to facilitate easy payments straight from the invoice window. For example, clients can pay via credit card or bank transfer without ever leaving the document.

- Automation: Invoice software often has many automated features, including automatic reminders when payment is due. This is a major benefit because chasing clients for money can often be awkward and uncomfortable.

- Powerful Tools: Invoicing software keeps detailed information about your products and services, including their price per unit. The software can also store client information, taxation, and discounts, saving you valuable time when creating new invoices.

- Cloud-based: Most invoicing software is cloud-based, meaning your invoices are stored online in a safe and secure location. Keeping invoices on your hard drive can take up valuable space and increase your risk of losing your invoices altogether if your device is lost, stolen, corrupted, or compromised by hackers.

Batoi Corporate Office

Batoi Corporate Office